My weekly column from the Lewiston (Idaho) Tribune.

On an out of the way country road a few miles outside of Oxford, Mississippi you’ll find a place that claims to serve “the best catfish in the South.” The Taylor Grocery, actually a general store turned restaurant with a rusty gas pump out front that once promised “ethyl,” is the kind of place where the chicken is fried, the comfort food is red beans and rice and the pork chop comes covered in gravy.

At Taylor Grocery you can have sweet tea, soda and coffee. If you want a beer with dinner you bring a couple bottles in a paper sack, be discreet about it and the waitress will bring you a glass – made of plastic.

I certainly remember the rib sticking food at the place, but also remember the sign out front with a simple message: Eat or We Both Starve.

That sign in front of a shabby looking restaurant in the hardwood and pine forest of northern Mississippi is just about the perfect metaphor for what should be the central debate in American politics at the moment. The American middle class is a sad hollowed out husk of my parent’s generation. Lost in the economic turmoil, resentment and downright despair of millions of Americans is the notion that a robust, expanding middle class is what really makes a capitalist system function. The guy pushing fried oysters in Taylor, Mississippi, or selling cars in Reno or peddling new dishwashers in Clarkston doesn’t eat the farmer or schoolteacher or carpenter can’t afford to buy. We all starve.

The Disappearing Middle Class…

Neither by mother or dad went to college, but they certainly saw to it that my brother and I did. They saw, properly so, that education was our society’s great advancer. They had every reason to believe, like their parents before them, that their kids would enjoy the American economic dream – a home, a car, an education and a decent job that would empower a whole new generation. We once considered that the American dream, back in the day when my dad could co-sign a $2,000 college loan that I could actually afford to repay.

But the stark reality is that the American dream for many fellow citizens is more illusion than expectation and there is evidence everywhere you look. The New York Federal Reserve reported recently that “a record 7 million Americans are 90 days or more behind” on their car payments, a metric that is genuinely worrying to many watchers of the economy. Many Americans are entirely dependent upon their automobile to get to work and they tend to make the car payment before anything else. That so many are so far behind is a stunner.

At the same time student-loan delinquency rates are going through the roof, more than $166 billion in delinquent loans in the fourth quarter of 2018 alone. As Bloomberg reports the total number of delinquent student loans is at a record $1.46 trillion.

Meanwhile, the prospects of a young American, even one with a good education, landing a job that will pay for the American dream are evaporating. In an article that manages to be both poignant and angry, Anne Helen Petersen wrote recently about why so many young Americans feel cheated by the enormous debt they have incurred to get a degree that then can’t produce a salary they can live on.

“The problem is the growing certainty that you were sold a false bill of goods about the immeasurable value of higher education,” Peterson wrote in BuzzFeed, “and that’ll you’ll be forever paying down the cost of a broken dream.”

There are dozens of realistic policy proposals to address these issues, including more focus on the affordability of community colleges and loan forgiveness programs that actually work. Peterson’s reporting confirms that many do not work and thousands of young people labor for years to make even a dent in their loan principal, let alone get to a level of financial security that allows a real pursuit of the dream.

The recent GOP tax bill has actually exacerbated the problem with graduate students who receive tuition breaks now required to treat those benefits as income. What kind of society taxes a young person for trying to get a master’s degree?

Party Like it’s 1929…

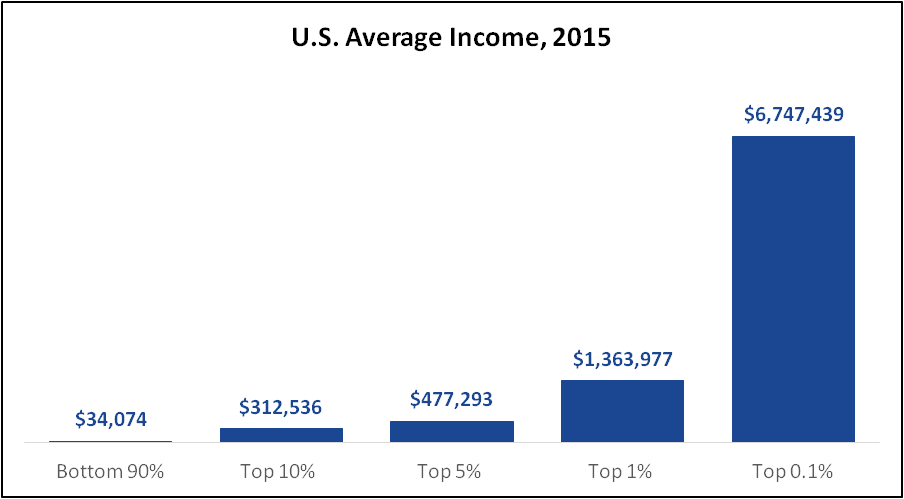

Meanwhile, the rich get richer and the middle class gets delinquency notices. University of California economist Gabriel Zucman recently published a paper on the continuing and dramatic growth in income inequality, another feature made worse by the Trump-Republican tax bill that was so enthusiastically supported by Idaho’s congressional delegation.

“U.S. wealth concentration has followed a marked U-shaped evolution of the last century,” Zucman writes. “It was high in the 1910s and 1920s … and the top 0.1% wealth share peaked at close to 25% in 1929.” The Great Depression stopped the increase and “after a period of remarkable stability in the 1950s and 1960s, the top 0.1% wealth share reached its low-water mark in the 1970s.” Now, “U.S. wealth concentration seems to have returned to levels last seen during the Roaring Twenties.”

The three wealthiest Americans – Jeff Bezos, Bill Gates and Warren Buffett – collectively have more wealth than the bottom 50% of the U.S. population, while about a fifth of Americans “have zero or negative net worth.” The only other places in the world were the wealth held by the super rich is as skewed are China and Russia. We truly are making oligarchs great again, while the folks who want to buy the appliances, the houses and hope to send their kids to school grow ever more marginalized.

The hollowing out of the once great American middle class, the loss of old-style manufacturing jobs, the decline of organized labor as a force for economic stability and worker protections, the skyrocketing cost of higher education and wage stagnation represent a crisis for American capitalism and politics. If fellow Americans aren’t reaping more rewards of the one-time American dream, we are all eventually going to starve.

—–0—–