The two foundational pillars of Republican (read Trump) economic policy – tax cuts and tariffs – have settled in on the country like so much else has for the last two and a half years. They are the product of ignorance, misdirection, wishful thinking and lies.

First, let’s review the bidding on the 2017 Trump tax cut passed with only Republican votes in Congress.

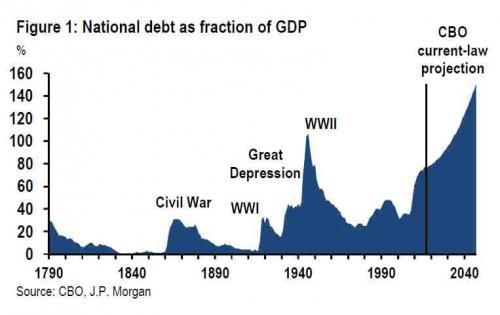

Idaho Senator Mike Crapo, a member of the tax writing Finance Committee said at the time, “The tax relief passed by Congress will reshape our tax policy to the benefit of Idaho’s taxpayers help make the United States more competitive.” Crapo was also sure that tax rates for all Americans would go down, jobs would spike, competitiveness would soar and “despite claims to the contrary, the reforms to our tax system will address our growing debt and deficits.”

In a joint statement with Crapo celebrating the passage of the tax cut, Senator Jim Risch was over the moon in touting the benefits. “The Tax Cuts and Jobs Act will produce growth not seen in generations, giving Americans access to higher wages, greater job opportunities and a more vibrant economy, all of which will result in greater dynamic revenue generation to reduce the deficit and improve our nation’s fiscal standing.”

But what has actually happened after the happy talk faded away? In as nutshell, and according to an in-depth analysis by the Congressional Research Service (CRS), a branch of the Library of Congress, Crapo and Risch’s claims were wildly overstated, indeed were largely wrong.

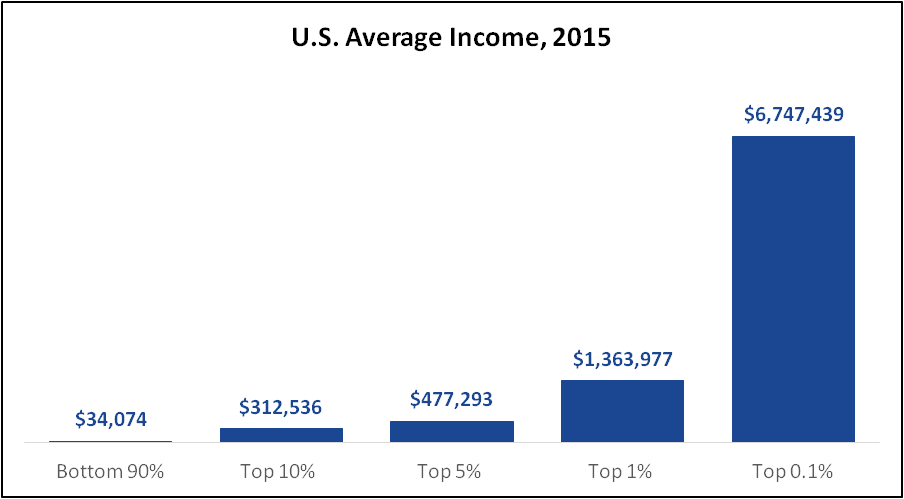

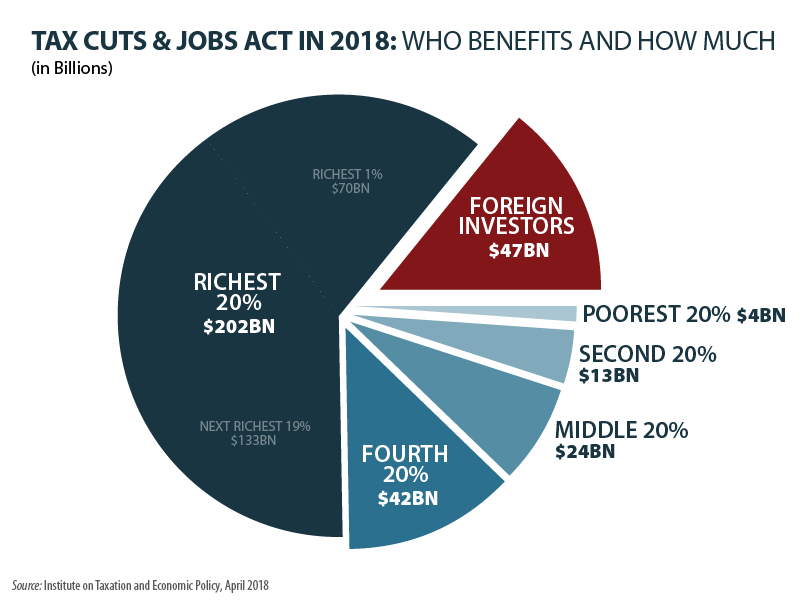

Consider who benefited from the tax legislation. “From 2017 to 2018,” CRS says, “the estimated average corporate tax rate fell from 23.4% to 12.1% and individual income taxes as a percentage of personal income fell slightly from 9.6% to 9.2%.” That helps explain why you saw tiny, if any, reduction in your personal tax bill, while corporations had their tax bill nearly halved.

The CRS analysis documents that much of the corporate tax cut went not to investment in workers or plants, but for “a record-breaking amount of stock buybacks, with $1 trillion announced by the end of 2018.” In other words, investors, corporate CEO’s and the already well to do enjoyed the benefits.

And how about the notion that cutting government revenue would some how magically contribute to a reduction in government debt? Here’s how Los Angeles Times columnist Michael Hiltzik describes what happened: “Overall revenue fell in 2018, largely because of a $40-billion decline in corporate tax revenue. Individuals, particularly working- and middle-class individuals haven’t been so fortunate. Although the legislation increased the standard deduction and child credit, whatever tax reductions those would produce for families were ‘largely offset’ by the elimination of personal exemptions, and limitations on itemized deductions such as those for state and local taxes.”

In point of fact the federal deficit – remember when Risch and Crapo used to talk about that all the time – has increased by 40% in the current fiscal year, at a time when the economy continues to grow. This is more than blue smoke and mirrors masquerading as economic policy. It’s really economic malpractice on a huge scale. Congressional Republicans sold you a bill of goods and most of them continue to mouth the platitudes about how good it is for you.

Let’s consider the other “T” in Trumpland economics: tariffs. Despite mounting evidence of the impact on Idaho of the administration’s tariff wars with China, India and a host of other countries, Risch and Crapo stand at attention and march over the economic cliff with the president. Trump, don’t forget, has taken his tariff actions in an unprecedented manner, invoking a provision meant to deal with matters of national security. The Constitution expressly reserves to the Congress the “Power To lay and collect Taxes, Duties, Imposts and Excises.” In other words, Congress has acquiesced to this presidential power grab.

Risch recently told a television interviewer that he’s “not a tariff guy,” chuckling that Republicans “are free traders.” Yet when given the chance to even mildly rebuff Trump – the Senate last year approved 88-11 a non-binding objection to a tariff war – Risch declined, as Crapo did, citing “onerous restrictions” on the president’s authority to implement tariffs for national security reasons.

Even if Trump manages to navigate a pathway out of his tariff cul-de-sac some time soon much damage has already been done. Supply chains have been disrupted, long-to-develop trading relationships shattered and uncertainty dominates.

“Our businesses have spent a lot of time and a lot of money building relationships in some of these markets,” the Idaho Department of Agriculture’s Laura Johnson told the Idaho Press recently, “and as customers go somewhere else, it’s really hard to get them back. We may have other opportunities elsewhere, but it’s costly.” Jay Theiler, the Executive Director of Marketing for Agri Beef, a significant Idaho exporter, says, “Right now, politics is in the way of the trade.”

There is ample evidence that the president of the United States doesn’t understand how tariffs – or tax policy for that matter – actually work, that American consumers and businesses pay the duties when imports become more expensive and cutting tax rates increases the deficit. But, ignorance in politics isn’t a new phenomenon. What is unusual is the willful disregard of facts on the part of Idaho’s senators, and others, who have stood idly by while this economic malpractice continues to unfold.

Tax cuts and tariffs have done almost nothing beneficial for most Americans. If fact, GOP economic policy is costing you money. You would be entitled to ask: whose looking out for your interest?